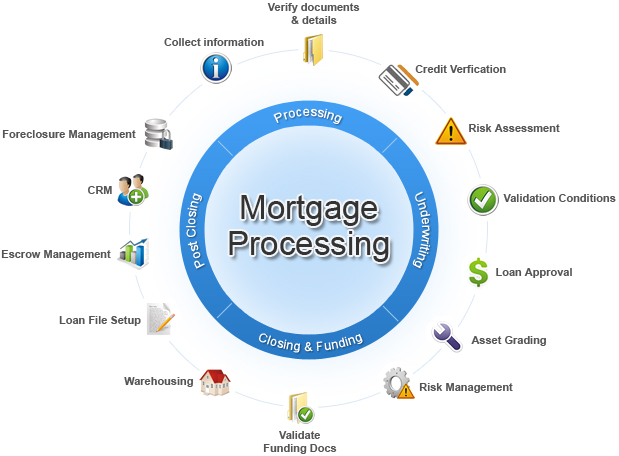

Mortgage basically involves a property ownership and money lending. It essentially involves a moneylender and the owner of the property. The Owner promises to pay the money in instalments to the moneylender. If the owner fails to pay the money, then the moneylender can resale the property to rescue the money back. Mortgage services include the following processes:

- Loan Process

- Underwriting support

- Closing support

- Post-closing support

- Title support

- Appraisal support

By seeing processes involved in mortgage services one can understand that the complexities and the time taken to complete these processes successfully before the loan can be approved. It would be would be an intellectual option to outsource Mortgage Services to India to save the infrastructure cost and your time. Outsourcing firms in India has experts in mortgage processing and years of experience to take these actions forward faster and more efficiently.

Dealing with Foreclosure

A Foreclosure happens when the borrower fails to repay the loan amount and the bank resells the property to recover the money. Due to complications in the foreclosure process and the increasing number of foreclosures every year, the bank works with best Mortgage Claim Processing firms with expertise. They will do all the legal documentation and maintain the confidentiality of your documents. To save time and cost, and to use your resources effectively, outsourcing mortgage processing is an excellent option. The experts will take care of the following legal procedures to claim the money.

- Foreclosure Entry & Processing

- Foreclosure documentation

- Pre-foreclosure evaluation

- Post-closing support

Outsourcing Mortgage Processing

It is wise to choose outsourcing firms in India to achieve excellent technical support, flawless services and accurate deliverables. Data entry becomes tedious when the business broadens in size. To train the resources on this task, you need to spend time and effort. Instead, approaching a competent Mortgage Entry Services provider will yield benefits such as

- Time and effort

- Hiring and training cost

- Administrative cost

- Assured Accuracy in the data

- Customer satisfaction

- Cost on expensive software and infrastructure

Compared to the freshly trained resources, an expert can handle complex data smartly. So it is highly beneficial to find the right outsourcing partner. Mortgage processes that can be outsourced are:

- Pre-qualification

- Pre-processing

- Closing

- Post-closing

Mortgage process typically involves a sequence of processes right from collecting personal information and financial records for the loan. These processes need to be done under the supervision of middle management or by the senior managers. It requires a huge amount of time to finish one mortgage process. Customers may move to competitors if the process gets delayed. To hold customers and to use senior manager’s time and potential on other beneficial activities, outsourcing is an excellent choice for companies even if small in size.

Benefits of outsourcing Mortgage Processing to India are appreciable than the cost spent.

- Minimize Cost and Operational Time

- Faster turn around

- Improves customer satisfaction

- Reduced time and attention required from managers

Check benchmarks of outsourcing partners before you begin to work with them.