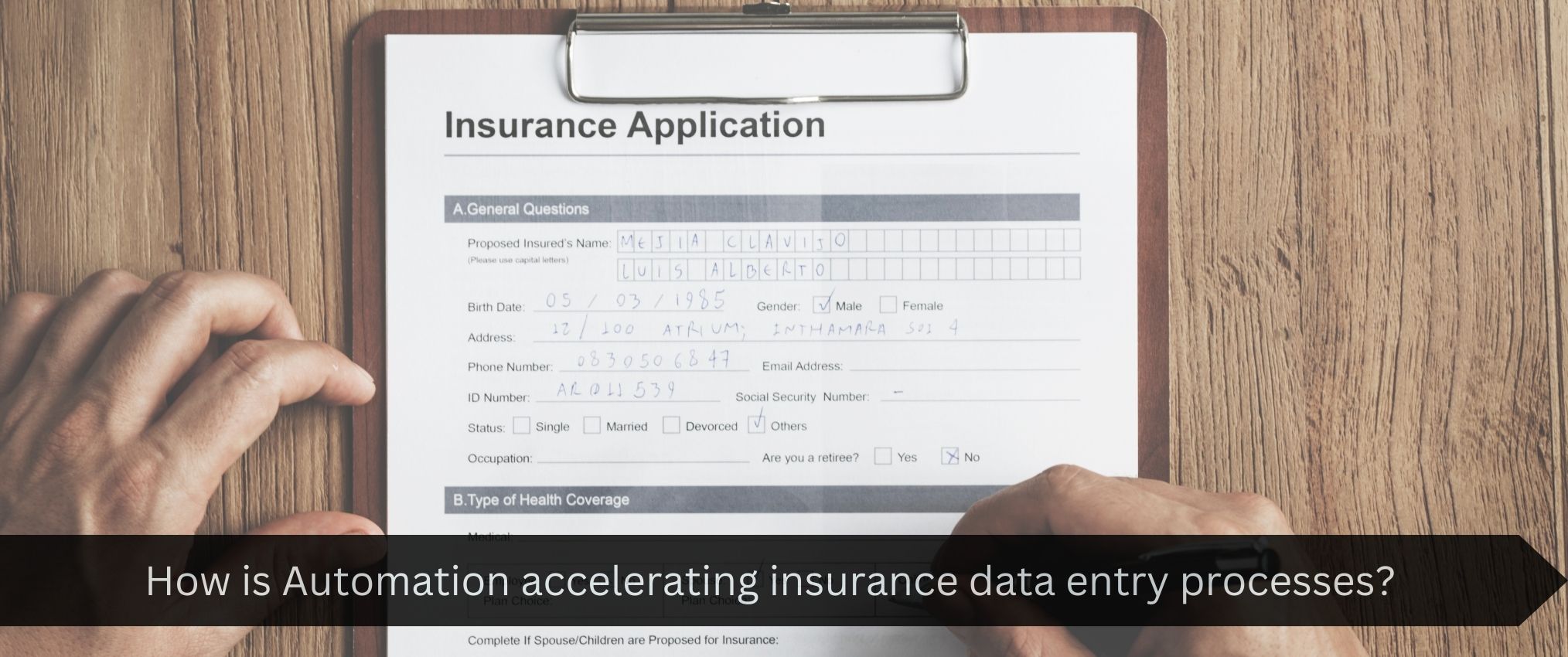

How is automation accelerating insurance claims data entry processes?

How is automation accelerating insurance claims data entry processes?

Smart automation is revolutionizing business enterprises of all kinds at a staggering tempo. From basic back office work to large power plants, the adoption of automation trends has become habitual. The insurance business is a large sector that processes huge volumes of claims, data, and policies every day. It’s clear that the latest automation trends and software can make significant changes in the way insurance companies work. Here are some reasons why automation in insurance claims data entry has become a necessity for insurance businesses.

Enforce cost-cutting measures

Automation software and technologies allow businesses to reduce expenses in many areas of work. Automated data entry reduces the need for manual labor; hence, you can save on expenses such as hiring, training, induction classes, etc. Moreover, modern technologies and automation software can carry out tedious tasks easily. Automation software and technologies such as Docsumo, Abby Flexicapture, Kofax, etc. are widely used in insurance data entry processes all over the globe. These software automate insurance claims data entry processes by reducing manual typing and delivering output quickly.

Manually typing insurance claims is a risky process and prone to errors. Simple errors can be costly for insurers, as they deal with plenty of paper documents. Alphabetical and numeral mistakes in data such as name, address, or salary can put your reputation on the line. Automating insurance claims data entry eliminates expensive mistakes while typing and helps save unnecessary expenses on labor, resources, welfare, and much more.

Superior decision-making skills

Automation software and outputs help insurers make effective decisions based on real-time data analysis. Automation of insurance claims data entry reduces errors that arise from a lack of focus and stress while manually entering claim data. Substituting these error-prone techniques with automation software reduces risks. Therefore, they help businesses make informed decisions and estimations of claims based on accurate data. These small elements play an important role in underwriting and making up pricing policies.

Automation software is very effective in data management systems as it helps organize, manage, and store confidential information accurately. Businesses can confidently rely on this data anytime, as it is collected, processed, and stored accurately. As a result, automation of insurance claims data entry helps insurers and claimees streamline their businesses and derive meaningful insights from them.

Accurate data management

Data automation and processing are big assets for organizations as they help to keep a clean database management system. Accurate data management improves the customer experience, operational efficiency, and compliance with regulatory standards. Smart automation software can process large volumes of data in a narrow window of time. And for the best part, the room for errors is very small compared to manual typing.

Insurance companies have to deal with plenty of legal compliance, regulatory protocols, and security concerns, as they have to deal with confidential data all the time. Moreover, accurate data management helps the company monitor its performance and mitigate risks. Automation allows insurance companies to calculate risks and determine schemes accordingly. Incorrect assessments are risky as they can cost a lot of money and can end up making bad choices and underpricing schemes. Therefore, accurate data entry not only improves operational efficiency but also helps insurance companies save costs and increase productivity.

Improved customer care

With reduced processing times and fewer errors, automation of insurance data entry can improve customer service and communication. Smart automation software enables data to be addressed accurately, which reduces the time to process customer requests and deal with claims. Addressing and solving these insurances with automated software gradually leads to faster resolution of issues and better communication. Accurate claim processing reduces the delay time and frustration of the customers to a great extent. Moreover, automation software allows customers to know real-time updates and the status of their claims.

Keeping customers informed of their claims or insurance boosts their loyalty and trust in the organization. Nevertheless, automated systems ensure that customer details and credentials are secure from breaches and potential hacks. Insurance and claims contain confidential information, and customers feel safe when they know that the data is handled responsibly. Thus, automation systems and software improve the customer experience, resulting in better communication, data security, and a streamlined workflow.

Conclusion

By concluding the facts, implementing automation tools and software helps businesses improve their overall operational accuracy in all sectors. To stay competitive and elevate your company’s goals, automating tedious tasks is a perfect choice for companies of all sizes. Smart automation in insurance claims data entry can reduce time, effort, and errors while achieving maximum productivity. We are the leading data entry outsourcing company, with over a decade of experience and happy clients all over the globe. If you’re planning to outsource insurance claims data entry, we are the right choice for you. Send mail to us at info@dataentryindiabpo.com and let’s get started!